Disclaimer: This post may contain affiliate links. For more information, please visit our Disclaimer Page.

Introduction

The book, a recollection of Robert Kiyosaki’s life, narrates his encounters with two important figures who have shaped his perspective on money, work, and financial success – his biological father, dubbed the “poor dad.” His friend’s father is referred to as the “rich dad.”

The author of rich dad poor dad presents a stark comparison between the divergent views on money and work held by the “poor dad,” who espoused the conventional notion of formal education, a secure job, and a prudent approach to finances, and the unorthodox views of the “rich dad,” who believed in financial literacy, entrepreneurship, and calculated risk-taking.

With vivid anecdotes and personal experiences, the author brings to life how the lessons he learned from his “rich dad” ultimately led him to financial independence and a successful life. The book is a testament to the power of challenging conventional wisdom and seeking alternative paths to financial success.

Why read the book Rich Dad Poor Dad? What does it teach?

What does the rich teach their children about money that poor, middle-class parents do not? How to earn money and spend it is not prepared for us in any school or college.

Maybe that’s why the rich get richer and the poor get poorer. The life of a middle-class family consists of repaying a loan.

It is not wrong to say that money is a form of power, but financial literacy is even more powerful. Money comes and goes, but if you know how money works, you can control it and build wealth.

Most of us learn about money from our parents, but what can poor parents teach their children about money? Such a child may graduate with good grades, but his understanding and attitude toward money will remain the same as that of a poor person.

The most significant disadvantage of today’s education system is that we must be taught about money.

This book is about Financial Literacy. To be rich, knowing Financial Literacy and regular studies is very important. “Rich Dad Poor Dad” is one of those books.

| RICH DAD | POOR DAD |

| Robert’s biological father | His friend’s father |

| Highly intelligent and educated; holds a PhD | Only had an 8th-grade education |

| With a well-paying job but struggled financially throughout his life | Went on to become one of the wealthiest men in Hawaii |

More than just earning a lot of money is needed to get rich. Money management, making more money with money, and all that work lead to wealth. So who wants to get rich? I must read this book. It breaks a lot of misconceptions people have about money.

The book highlights nine key principles, including financial literacy, the difference between assets and liabilities, the power of passive income, the dangers of depending on a traditional job for financial security, and the importance of taking calculated risks.

So, take a cup of tea and accompany me throughout Kiyosaki teachings.

Lesson 1: The Rich Don’t Work for Money

Most people have been trapped in a certain circle for decades; the author calls it the rat race. Most people’s lives are all about studying at a good college, finding a good job and getting married, and then continuing to pay off loans for things like a house and car with your lifetime salary.

People don’t realize that they work hard in this kind of life, but the benefit of their hard work goes to someone else. Many people are not even happy to be a part of this rat race, but because of their fear, greed, and domestic responsibilities, they remain part of it under compulsion.

Rich dad says we must first get out of this rat race by ending our fear and then do something where you shouldn’t work for money, but money should work for you. There is an old saying – money attracts money. Likewise, doing something where your money will get you would be best.

Most people have been trapped in a certain circle for decades, and the author’s rich dad calls it the rat race. Most people’s lives are all about studying at a good college, finding a good job and getting married, and then continuing to pay off loans for things like a house and car with your lifetime salary.

People don’t realize that they work hard in this kind of life, but their hard work benefits someone else. Many people are not even happy to be a part of this rat race, but because of their fear, greed, and domestic responsibilities, they remain part of it under compulsion.

We must first get out of this rat race. In the first lesson, Aamir’s father explains that fear and greed control most people’s lives. People do this work so that there is plenty of money. And as soon as the money arrives, the greed to buy other new things also wakes up.

So this greed forces them to earn more money. And the fear of not being able to pay the bills.

Robert calls it the Tax Rush and how people are trapped in this race because of fear and greed. It’s not that people like this breed. But the things that have been on people’s minds since childhood keep them part of that race.

It was taught from childhood to study well and get a good diploma. So do a good job. If you try something else, you will only fail. It will not allow anyone else to succeed. And that’s what keeps people connected to this breed.

Indeed, you will never be poor for being part of this tariff race. You will be able to pay your bills. Will be able to buy luxury. But you will never be able to get rich. You will not be able to live a quality life. You have to follow that boring routine every day until retirement.

Lesson 2: Why Teach Financial Literacy

In this world, you will find many sportsmen, celebrities, and people who were once very rich but have nothing today. People become poor and rich this way because they don’t understand money. This means they need to gain skills to keep and earn money.

Kiyosaki says he met prominent businessmen and investors in Chicago Beach and discussed money with them at a business meeting. Twenty-five years later, a report said that wealthy businessmen and investors in Chicago were wealthy. Some of them went to jail, some of them died, and some of them remained poor.

We have learned from the results of all these unhappy entrepreneurs that it is crucial to have money to be safe. That’s why the author says that no matter how much money you earn if you don’t invest that money wisely in the right place, you can’t get rich and protect yourself in the future.

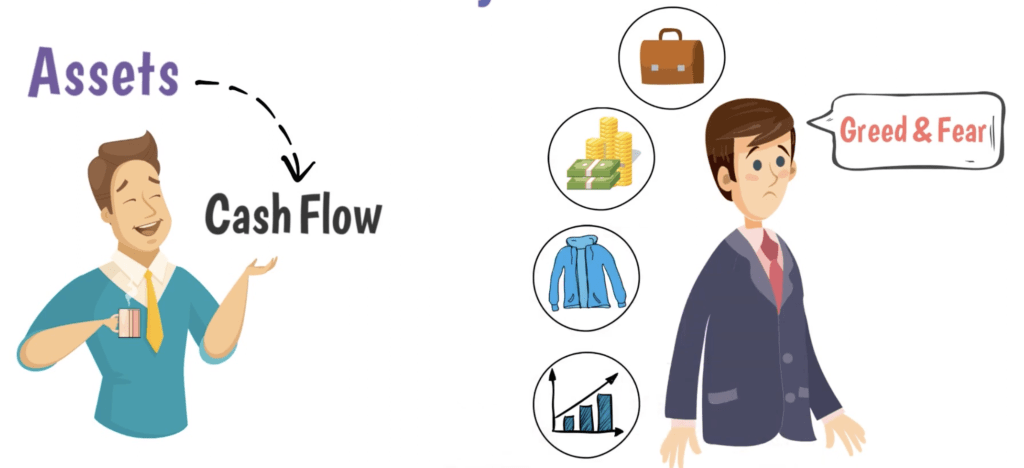

Robert Kiyosaki says that intelligence solves problems and also makes money. Money moves fast without intelligence, and the author believes that knowledge of financial things comes from accounting knowledge. Therefore, you must understand the difference between assets and liabilities.

What are Liabilities and Assets?

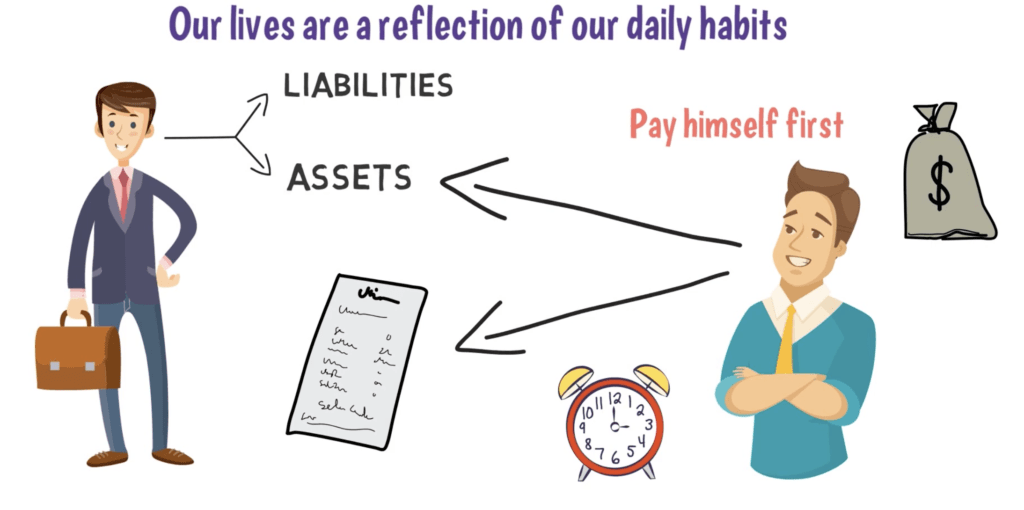

Are you familiar with the distinction between assets and liabilities? The concept is simple yet critical in determining your financial future. Assets bring in money, whereas liabilities drain it from your pockets. To attain wealth, make it a habit to acquire assets throughout your life. Conversely, indulging in liabilities will ensure a life of mediocrity or poverty.

Sadly, most people struggle with financial stability due to ignorance of this basic principle. Despite their tireless efforts to earn money, they need to accumulate wealth. This is primarily due to their misallocation of funds towards liabilities rather than assets.

Do you have a grip on your money? Can you answer questions like “What should I do with my money after earning it?” or “How can I make money work for me?”

Understanding money and its flow is essential to managing your finances. A person could have an impressive educational background and run a successful business but still need an understanding of money.

The conventional wisdom of “working hard” is not enough. Unfortunately, many people fall into this trap and, as a result, end up working harder than necessary.

They forget that the ultimate goal is to make money work for them rather than the other way around. Don’t be one of them; start managing your finances wisely and watch your wealth grow.

If you feel that you are stuck in a hole, stop digging the hole. The power of money often controls poor and middle-class people.

They get up early in the morning and go to work hard, that is, to do a job, and they don’t even ask themselves if it’s wise to do it.

Due to a lack of understanding of money, most people allow the fearsome power of money to control them. The power of money is used against them.

Can we ask ourselves if this makes sense? Instead of trusting our inner wisdom, we follow the crowd. We often repeat what we have been taught out of ignorance. Living with the crowd and copying the neighbors’ luxuries creates many money problems.

The most important rule of thumb for getting rich is to recognize the difference between Assets and Liabilities and always try to buy the Assets that make you money. Along with that, keep trying to reduce your liabilities and expenses as well.

Lesson 3: Mind Your Own Business

Landing your dream job may seem like the ultimate goal, but Robert‘s wise father knows it’s just the start. With the right mindset and effort, anyone can turn their side hustle into a thriving business empire. Take Ray Kroc, the mastermind behind McDonald’s, for example. Despite being best known for his fast food empire, Ray’s real money-maker was real estate. By expanding his chain of restaurants, he eventually became the largest real estate owner in the world, amassing great wealth along the way.

The key to following in Ray’s footsteps is to focus on developing your own business, becoming your boss, and seeking out additional sources of income. The possibilities are endless, whether starting a business, investing in mutual funds or the stock market, or even exploring the world of real estate and finding profitable properties. Financial independence and commercial success are well within reach with determination and focus. So why settle for just one job when you can become the king of your business empire?

Lesson 4: The History of Taxes and the Power of Corporations

Throughout history, taxes have evolved from being a burden solely on the affluent to a responsibility shared by individuals across all socio-economic classes. However, contrary to common belief, it is more than just the wealthy who bear a heavier tax burden in modern times.

In reality, the middle class often pays a greater share of taxes, while the rich can effectively minimize their tax liability through mastery of tax laws and access to experts.

Corporations, a separate legal entity distinct from their owners, allow the wealthy to reduce their tax obligation. The corporate tax rate is often lower than the personal income tax rate, providing a significant advantage to the wealthy who invest in companies.

Additionally, corporations can spend funds before paying taxes, reducing the amount of taxes owed. This is why many wealthy individuals opt to invest their money in corporations.

Now, let’s delve into comparing how taxes are paid by the wealthy and the middle class.

The wealthy, who often own large corporations, reap profits, then spend them, and only pay taxes on the residual funds they retain.

Lesson 5: The Rich Invent Money

Trapped in a never-ending cycle, many individuals find themselves trapped in what the author calls the “rat race.” Despite their tireless efforts, their hard work only benefits others, while they remain unfulfilled. This cycle of monotony is perpetuated by fear, greed, and domestic responsibilities that keep people bound to this life of servitude.

But, as the author‘s wealthy mentor, Rich Dad, suggests, breaking free from this cycle requires a shift in perspective. We must conquer our fears and strive to make money work for us rather than the other way around. By harnessing the power of money, we can achieve true financial freedom and stability.

However, societal expectations often perpetuate the rat race. From a young age, people are taught to value stability above all else and to seek a secure job with a steady income. This single-minded pursuit of security and stability, often driven by fear and greed, keeps individuals trapped in this cycle.

Robert dubs this the “Tax Rush,” as people are caught in this race due to their fears and greed. The idea of failure, ingrained in our minds since childhood, prevents individuals from exploring new avenues and taking risks that could lead to greater success and wealth.

While being a part of the rat race may provide comfort and security, it will never lead to true wealth or a fulfilling life. People are confined to a routine of drudgery until retirement, never escaping the monotony of their daily lives. Kiyosaki encourages individuals to break free from this cycle and embrace life’s opportunities.

Lesson 6: Work to Learn – Don’t Work for Money

Ideas are only as good as the actions taken to bring them to life. A successful business is built on the foundation of acquired knowledge. The author has gained an extensive understanding of various industries through a lifetime of work, which has propelled him to success.

He doesn’t view work as a means to earn a monthly salary but as an opportunity to learn, observe different fields, network with experts, and gather valuable information that can be applied to his own work.

Breaking free from the rat race, as the author’s father refers to it, is the first step to achieving success. As Robert calls it, the cycle of fear and greed keeps people trapped in the Tax Rush. The messages ingrained in people’s minds from childhood–to study hard, get a good job and follow a certain path–limit their potential for success and keep them in this cycle.

The constant pursuit of money driven by greed and the fear of being unable to pay bills creates a vicious cycle. But this cycle doesn’t have to be one’s reality. By breaking free and acquiring knowledge in various fields, one can work towards creating a successful business that goes beyond just paying the bills.

Lesson 7: Overcoming Obstacles and Being Fearless

The distinction between the wealthy and the financially struggling lies in their respective fear management. The author argues that five factors prevent even those with sound financial knowledge from building wealth-generating assets:

Overcoming Fear :

Robert asserts that in his experience, there is not a single individual who relishes losing money, nor has he encountered a wealthy person who has not suffered financial losses at some point. However, he has encountered many individuals who, despite never having invested a single penny, lead lives of poverty.

While the fear of losing money is widespread, the real challenge lies in managing that fear and handling the aftermath of financial loss. How one reacts to failure separates the rich from the poor. Winners are inspired by failure, while it demoralizes losers.

For most people, the fear of losing money is more potent than the excitement of getting rich, preventing them from acquiring wealth. If you are over 25 and hesitate to take risks, it’s time to reconsider your approach. Of course, caution is necessary, but it’s important to start taking calculated risks early on.

Overcoming a Pessimistic Outlook: Breaking Free from Doubts

The tale of the alarmed chicken shouting, “The sky is falling! The sky is falling!” is well known. We all harbor doubts and insecurities that can render us inactive.

The “what if” scenarios that play in our minds, such as “What if I lose my money on this investment?” or “What if things don’t go as planned?” can be so intimidating that they prevent us from taking action and missing out on promising opportunities.

However, it is essential to move past these fears and overcome pessimism. We must learn to ignore our doubts and push forward, embracing new opportunities and experiences with open arms.

Conquering Laziness: Balancing Priorities

The common belief is that the busier people are, they become less lazy. However, as this allegory illustrates, this is only sometimes the case.

A successful businessman dedicated himself to his work, often working long hours at the office and bringing work home, even on weekends. One day, he returned to an empty house, as his wife and children had left due to his neglect of their relationship.

Instead of mending the broken bonds, he buried himself even deeper in his work, leading to a downward spiral of disinterest and eventual job loss. When taken to an extreme, Busyness can cause one to become so focused on a single aspect of life that they neglect everything else.

The key to overcoming laziness lies in a healthy dose of ambition.

Ask yourself, “What would my life look like if I never had to work?” You can ignite the drive to push past laziness by striving for something better. However, it’s important to remember that moderation is crucial; too much of anything, even ambition, can be harmful.

Breaking Bad Habits: The Power of Small Changes

We often underestimate the impact our habits have on our lives. They can often be more influential than our education or background.

Robert emphasizes prioritizing oneself, stating, “Putting myself first, financially and mentally, has made me stronger overall.” This principle applies to personal finance as well. It’s essential to establish the habit of paying yourself first to achieve wealth, even if your financial situation is modest.

By doing so, you reap two significant benefits. First, your wealth will steadily grow over time. Second, you open yourself up to additional earning opportunities. Start small and watch as good habits transform your financial future.

Transcending the Ego:

Learning to transcend the ego is a key factor in financial success. Rich dad often said that possessing knowledge was the only way to make money, while ignorance could lead to significant losses. Unfortunately, many people mistake masking their lack of knowledge with arrogance.

It is not a requirement to be an expert in every subject, but having a level of understanding rather than exhibiting prideful behavior is certainly beneficial. Rather than relying on ego, striving for knowledge and understanding can be a more beneficial path. Acquiring and utilizing information can lead to greater gains than simply trying to appear as if one has it all figured out.

Lesson 8 – Getting Started

The eighth chapter of “Rich Dad, Poor Dad” is a call to action, urging readers to make a tangible move toward financial success. Kiyosaki emphasizes that simply dreaming or discussing financial independence isn’t enough; one must actively strive toward it. He propounds that even a small step, taken consistently, can lead to great results.

The author stresses the significance of education and exploring diverse investment opportunities, reminding readers to embrace calculated risks to build wealth. He also encourages the development of savings and investment habits, a strong work ethic, and a positive mindset toward money.

Kiyosaki views wealth-building as a marathon, not a sprint, and underscores the significance of patience and persistence in the journey toward financial freedom. Lesson 8 of “Rich Dad, Poor Dad” instructs readers to start their financial journey, continue learning, and strive towards their financial objectives with unwavering resolve.

Lesson 9 – The Compound Effect

The “Compound Effect” – is a term that speaks volumes about the impact of exponential growth. It refers to the magical power of compound interest, where money invested consistently over time multiplies itself and produces an exponential return.

This lesson, straight from the pages of Robert Kiyosaki‘s book “Rich Dad, Poor Dad,” underlines the significance of starting early and continuously adding to your investments to harness the full potential of the compound effect and secure your financial future.

Kiyosaki emphasizes that, just like compound interest, small, consistent actions can lead to massive outcomes. He believes that the compound effect applies to all aspects of life, including finances, and urges readers to invest in themselves by acquiring knowledge, capitalizing on investment opportunities, and developing discipline and patience to keep their investments for the long run.

The central message is that, with small but consistent steps, you can achieve substantial results over time, and utilizing the power of the compound effect is crucial in pursuing financial freedom and wealth creation.

Takeaways from “Rich Dad Poor Dad” by Robert Kiyosaki:

| Market Opportunities | Kiyosaki encourages readers to be able to spot market openings and take advantage of money-making opportunities. |

| Job Skills over Job Money | He recommends young people seek jobs for the skills they can learn in that job rather than the money they can make. |

| Key Job Skills | Kiyosaki identifies three of the most valuable skills to look for and develop in a job: the management of cash flow, the management of systems, and the management of people. |

| Purpose Driven | He suggests that individuals should find a purpose or reasons bigger than themselves to motivate them on their journey with personal finance. |

| Pay Yourself First | Kiyosaki recommends “pay yourself first” and not overspending your income on luxuries. Instead, use assets to buy luxuries. |

| Choose Your Heroes | He suggests choosing heroes who can provide guidance and advice to help make the right financial decisions. |

| Sharing is Caring | Kiyosaki encourages people to share their knowledge and “pay it forward” to help others with personal finance. |

Conclusion

The primary goal of the Rich Dad, Poor Dad book was to increase people’s financial literacy. This book has a wealth of information to help you manage your money.

Robert emphasizes the significance of two gifts – the mind and time – in building wealth. Every dollar that comes into your hands is a choice, and it’s up to you to decide how to use it wisely. Investing in assets rather than liabilities can build wealth over time.

Read Rich Dad Poor Dad if you want to take charge of your financial future.

Tell us your thoughts on this Rich Dad, Poor Dad book summary! Feel free to leave us a remark below if you have any inquiries or recommendations. We’ll do everything in our power to address your concerns.

F.A.Q. about “Rich Dad, Poor Dad” by Robert T. Kiyosaki

What is “RICH DAD, POOR DAD” about?

“Rich Dad, Poor Dad” by Robert T. Kiyosaki gives good financial advice. Kiyosaki makes fascinating parallels between how the affluent and poor think about money and their financial well-being. This captivating book reveals the keys to financial success. “RICH DAD, POOR DAD” is recommended reading for anybody serious about financial control due to Kiyosaki’s skill and personality.

Who is Robert T. Kiyosaki?

Robert T. Kiyosaki has impacted personal finance and entrepreneurship for over three decades. “Rich Dad, Poor Dad,” his landmark work, has become synonymous with sensible financial advice and wealth-generation tactics. Through his persistent devotion to financial education, Kiyosaki, a master of financial literacy and an advocate of individual financial empowerment, has impacted the lives of countless people. His best-selling books and captivating talks have motivated individuals worldwide to take control of their finances, pursue their financial aspirations, and plan a course to success. Kiyosaki’s influence on personal finance demonstrates his grasp of the subject and ability to make difficult financial concepts understandable to a broad audience.

Is “RICH DAD, POOR DAD” a good book for beginners?

“RICH DAD, POOR DAD” – An Indispensable Guide for Financial Growth! This book by Robert Kiyosaki is a must-read for anyone embarking on a financial journey. Its simple, straightforward language and actionable advice make it a perfect fit for readers of all levels of expertise. Whether you’re just starting out or want to elevate your financial game, “RICH DAD, POOR DAD” tops the list. It’s an indispensable resource that enlightens you about money, wealth, and investments and teaches you how to make the most of them. By reading this book, you arm yourself with the necessary tools to lay a robust financial foundation, a step closer to achieving financial freedom. Get your hands on this gem, and take the first step towards financial literacy and prosperity.

What are some key lessons from “RICH DAD, POOR DAD”?

This book, authored by Robert Kiyosaki, is a treasure trove of financial wisdom. It reveals the significance of differentiating between assets and liabilities, highlights the transformative power of financial education, and emphasizes the need for passive income. But that’s not all. “RICH DAD, POOR DAD” challenges conventional thinking about money and wealth and equips you with practical strategies to construct a rock-solid financial foundation and attain financial independence. Embrace the lessons imparted in this book, and embark on a journey towards financial literacy and prosperity.

“Rich Dad, Poor Dad” Quotes

“The rich don’t work for money.”

“If you want to be rich, you need to understand your money.”

“An asset puts money in your pocket. A liability takes money out of your pocket.”

“A job is only a temporary solution to a permanent problem.”

“The poor and middle-class work for money. The rich have money work for them.”

“You are either a master of money or a slave to it.”

“In order to become financially free, you need to know the difference between an asset and a liability.”

“Your house is not an asset. It’s a liability.”

“The more you learn, the more you earn.”

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

Disclaimer: This blog post is a summary or resume of the book and is not intended to dispense the reading of the original book. This post aims to provide a general overview of the book’s main ideas and themes and encourage readers to read the complete book to gain a deeper understanding of the material. The information presented in this post is intended to be something other than a substitute for the original book and should be used as a supplement to, not a replacement for, the entire book. We strongly encourage readers to read the complete book to benefit from its ideas and teachings fully.